magicreels9.ru

Community

Bitconect Coin

How did the fraudsters commit the crime? Through the BitConnect Lending Program, users could exchange Bitcoin for BCC. BCC's daily market value and daily. USD Solana USD. +%. USDC-USD USD Coin USD. %. XRP-USD XRP USD. +%. STETH-USD Lido Staked ETH USD. 2, +%. DOGE-USD. BitConnect coin is an open source, peer-to-peer, community driven decentralized cryptocurrency that allow people to store and invest their wealth in a non-. Track current Bitconnect prices in real-time with historical BTCN USD charts, liquidity, and volume. Get top exchanges, markets, and more. BitConnect (BCC) was an allegedly open source cryptocurrency and the native token of the now-defunct ponzi scheme BitConnect. Launched in February Popular Cryptocurrencies Trending crypto tokens and coins on CoinCheckup. There's not enough data on BitConnect to calculate BitConnect price performance. The BCC coin of Bitconnect enables a self regulated financial system, which consists of staking, mining, investing and trading. Links. Website, magicreels9.ru USD Solana USD. +%. USDC-USD USD Coin USD. +%. XRP-USD XRP USD. +%. STETH-USD Lido Staked ETH USD. 2, +%. DOGE-USD. BitConnect is a cryptocurrency investment platform that was launched in It promised high returns through a lending program and a trading bot. How did the fraudsters commit the crime? Through the BitConnect Lending Program, users could exchange Bitcoin for BCC. BCC's daily market value and daily. USD Solana USD. +%. USDC-USD USD Coin USD. %. XRP-USD XRP USD. +%. STETH-USD Lido Staked ETH USD. 2, +%. DOGE-USD. BitConnect coin is an open source, peer-to-peer, community driven decentralized cryptocurrency that allow people to store and invest their wealth in a non-. Track current Bitconnect prices in real-time with historical BTCN USD charts, liquidity, and volume. Get top exchanges, markets, and more. BitConnect (BCC) was an allegedly open source cryptocurrency and the native token of the now-defunct ponzi scheme BitConnect. Launched in February Popular Cryptocurrencies Trending crypto tokens and coins on CoinCheckup. There's not enough data on BitConnect to calculate BitConnect price performance. The BCC coin of Bitconnect enables a self regulated financial system, which consists of staking, mining, investing and trading. Links. Website, magicreels9.ru USD Solana USD. +%. USDC-USD USD Coin USD. +%. XRP-USD XRP USD. +%. STETH-USD Lido Staked ETH USD. 2, +%. DOGE-USD. BitConnect is a cryptocurrency investment platform that was launched in It promised high returns through a lending program and a trading bot.

The current real time BitConnect price is $, and its trading volume is $0 in the last 24 hours. BCC price has plummeted by % in the last day. We are getting noticed, CoinCodex has removed BCC from Top , let us not stop until we put this coin to rest. Thanks to CoinCodex for taking. Scam coin. Reviewed in the United Kingdom on September 11, Looks like a great magicreels9.ruunately the actual bitconnect coin scammed out over a year ago. It takes a village to scam the world. Or at least some YouTube channels. In the penultimate episode of “Crypto Crooks: BitConnect,” we talk to Scott Shaffer. Get the latest price, news, live charts, and market trends about BitConnect. The current price of BitConnect in United States is $NaN per (BCC / USD). Bitconnect was an open-source cryptocurrency in – that was connected with a high-yield investment program, a type of Ponzi scheme. Followers, 0 Following, Posts - BitConnect Coin (@bitconnect_coin) on Instagram: "BitConnect Coin -> Decentralized Cryptocurrency -> Open Source. In depth view into BitConnect Price (DISCONTINUED) including historical data from to , charts and stats. BitConnect coin is an open source, peer-to-peer, community driven decentralized cryptocurrency that allow people to store and invest their wealth in a. The coin is inactive. We have not got price information for it, the last time we got price info was on Jul 6, If you think this is an error. Now defunct, Bitconnect operated as a platform that advertised significant profits in tandem with lending activities around Bitcoin and the Bitconnect coin. BitConnect PriceBCC. Coin. $ %. Wallet Buy Exchanges. Low (24h). High (24h). BitConnect Price Today. -. Coin. Mineable. Market Cap. BitConnect coin (or BBC abbreviation) is a cryptocurrency, a token of the peering payment system BitConnect. It is an open-source, all-in-one bitcoin and crypto. bitconnect is a centralized cryptocurrency exchange established in - and is registered in. Currently, there are 0 coins and 0 trading pairs available on the. This rate has been calculated based on last 15 days averages of the closing price registered on magicreels9.ru You are free to withdraw your BitConnect coin. BitConnect coin is community driven cryptocurrency that allow people to store and invest their wealth in a non-government controlled controlled currency. BitConnect coin (BCC) is a Ponzi scheme, a token of the peering payment system BitConnect, registered in Bitconnect review and history. to Bitconnect Coin by offering huge returns. Updated - April 02, am IST. Published - April 01, pm IST - NEW DELHI. Devesh K Pandey. BitConnect is in USD. Check back again soon. How can I buy 1 BitConnect on Coinbase? BitConnect is not currently available through Coinbase, but you can. BitConnect Coin is an open source, peer-to-peer, community driven decentralized cryptocurrency that allow people to store and invest.

Picking The Right Bank

12 Things To Consider When Choosing A Bank · 1. Security. Whether you choose to put your money in an online bank vs. · 2. Bank Fees. This is an important factor. Choosing and Using the Right Bank Account. Tips for getting more out of your checking and savings. Read the agreement from the bank that describes the account's. Choosing the Right Bank for Your Small Business · 1. Size matters. · 2. Check your credit. · 3. Approach Internet banks with caution. · 4. Location, Location. From tailored financial solutions and competitive rates to exceptional customer service and technological innovations, the benefits of choosing the right bank. What looks on paper like a no-fee checking account may not actually be the one that's best suited to your needs. Banks offer many different types of. Choosing and Using the Right Bank Account. Tips for getting more out of your checking and savings. Read the agreement from the bank that describes the account's. Looking for a little guidance on how to choose a bank? Consider these 11 leading factors to consider when picking the perfect bank for you. online banking; Minimum balance and deposit requirements; Fees; Access to ATMs; Interest rates; Mobile apps. To choose the right checking account, it's. For people new to the banking system, finding the right bank account can be a challenge. Banks ofer accounts with diferent features, costs, and requirements. 12 Things To Consider When Choosing A Bank · 1. Security. Whether you choose to put your money in an online bank vs. · 2. Bank Fees. This is an important factor. Choosing and Using the Right Bank Account. Tips for getting more out of your checking and savings. Read the agreement from the bank that describes the account's. Choosing the Right Bank for Your Small Business · 1. Size matters. · 2. Check your credit. · 3. Approach Internet banks with caution. · 4. Location, Location. From tailored financial solutions and competitive rates to exceptional customer service and technological innovations, the benefits of choosing the right bank. What looks on paper like a no-fee checking account may not actually be the one that's best suited to your needs. Banks offer many different types of. Choosing and Using the Right Bank Account. Tips for getting more out of your checking and savings. Read the agreement from the bank that describes the account's. Looking for a little guidance on how to choose a bank? Consider these 11 leading factors to consider when picking the perfect bank for you. online banking; Minimum balance and deposit requirements; Fees; Access to ATMs; Interest rates; Mobile apps. To choose the right checking account, it's. For people new to the banking system, finding the right bank account can be a challenge. Banks ofer accounts with diferent features, costs, and requirements.

Choosing the right bank for your business is an important decision that can significantly impact your financial success and overall operations. There are a lot of factors to consider. There is no one right bank account for every person. Choosing the right bank starts with knowing your bank usage and. Do you visit your bank a lot or do you do a lot of online banking? · Do you write a lot of checks or do you make mostly electronic transfers? · How much money are. Choosing the right checking account, paired with a local trusted expert Please choose your state to see HTLF divisional bank locations closest to you. Things I look for in a good bank are good customer service, not many fees, competitive rates, and a simple online banking experience. In this article, we will show you the key features of the best business bank accounts and how to select the right business checking account for your company. Find the right account for your needs. Security should always be top of mind, especially when considering an institution to hold your hard-earned cash. Whether you put your money in a bank or credit. The right bank will offer you the products, services, and support you need to help your business grow. Here are four qualities to look for in a good small. Although every bank allows you to save or borrow money, the difference is in the details with financial institutions. To choose the option that best fits your. Finding the right bank means first assessing your needs and then evaluating a potential banking relationship on how well it can meet those needs. Learning how to choose a bank involves understanding your needs, comparing the financial institutions available and considering which factors are influencing. If a bank is only open the same hours as your business, what happens when you need to deposit cash after closing? Choose a bank that is open early and late. If you are looking for a new bank or credit union, or just want to consider other banking options, here are some things to consider. To choose the right bank for your small business, it is crucial to understand your business's cash flow and revenue. Customers Bank is a super-community bank with over $22 billion in assets. We provide dedicated personal service for startups, small to mid-sized businesses. Deciding on the perfect bank doesn't have to be overwhelming, and this blog post will help you make an informed choice tailored to your needs and preferences. A business bank account will generally work for any business owner, but with a few questions you may be able to narrow down the exact type of business bank. Picking a bank is like selecting a new paint color for your room, you can always change your mind if you don't like the one you have chosen. To choose the right bank for your small business, it is crucial to understand your business's cash flow and revenue.

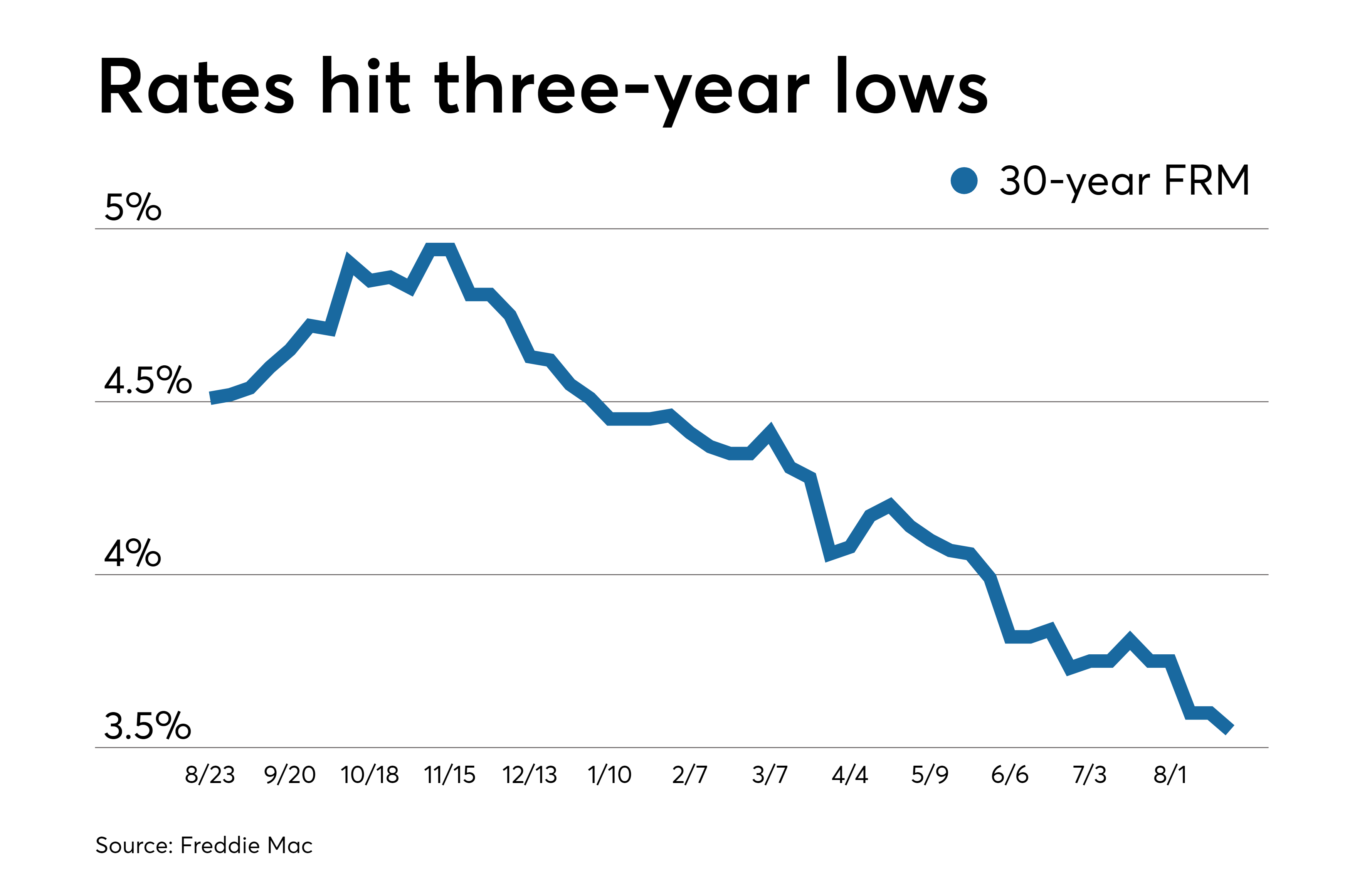

Who Has The Lowest Interest Rates

Most ARMs have a rate cap that limits the amount of interest rate change In order to provide you with the best possible rate estimate, we need some additional. CalHFA does not lend money directly to consumers. CalHFA works through and Interest rates and APRs are for comparisons only. Sample APRs include. What to know first: The best personal loan rates start below 8 percent and go to the most creditworthy borrowers. Personal loan interest rates currently. AHFC interest rates are posted daily Monday to Friday, excluding state holidays. AHFC does not offer direct lending on single family loan programs. Customized refinance rates. Estimate your monthly payments, annual percentage rate (APR), and mortgage interest rate to see if refinancing could be the. Which loan works best for you? Calculators. Which lender has the better loan? Should I pay points to lower the rate? What will my closing costs be? An. Compare the best low-interest personal loans ; Upstart. % to %. $1, to $50, ; PenFed. % to %. $ to $50, ; Prosper. % to %. Additionally, the current national average year fixed mortgage rate decreased 2 basis points from % to %. The current national average 5-year ARM. Our top picks for best low-interest personal loans are Discover (% to % APR), LightStream (% to % APR) and SoFi (% to % APR). Most ARMs have a rate cap that limits the amount of interest rate change In order to provide you with the best possible rate estimate, we need some additional. CalHFA does not lend money directly to consumers. CalHFA works through and Interest rates and APRs are for comparisons only. Sample APRs include. What to know first: The best personal loan rates start below 8 percent and go to the most creditworthy borrowers. Personal loan interest rates currently. AHFC interest rates are posted daily Monday to Friday, excluding state holidays. AHFC does not offer direct lending on single family loan programs. Customized refinance rates. Estimate your monthly payments, annual percentage rate (APR), and mortgage interest rate to see if refinancing could be the. Which loan works best for you? Calculators. Which lender has the better loan? Should I pay points to lower the rate? What will my closing costs be? An. Compare the best low-interest personal loans ; Upstart. % to %. $1, to $50, ; PenFed. % to %. $ to $50, ; Prosper. % to %. Additionally, the current national average year fixed mortgage rate decreased 2 basis points from % to %. The current national average 5-year ARM. Our top picks for best low-interest personal loans are Discover (% to % APR), LightStream (% to % APR) and SoFi (% to % APR).

"Best rate by far Fewest hoops to jump through We shopped a bunch of lenders and they were the best!" -BEN. "We got great. U.S. Bank Visa® Platinum Card: Best for a long intro period. Here's why: If you're seeking low interest rates over a long intro period, this card is worth a. Lower Interest Rate Credit Cards. A lower interest rate credit We've compiled some important considerations to help you pick the best credit card for you. LendingClub does not charge any application fee, broker fee, or What is a Good Interest Rate: Tips to Getting the Best Personal Loan Interest Rate. Compare the best personal loans and rates from top lenders without affecting your credit score. Rates starting at % APR and amounts up to $ Rates shown are lowest rate. Other rates and terms are available. Rate, term Interest Rate and APR are as of October 24, and subject to change. Knowing your mortgage rate is key for making informed financial decisions and securing the best deal. What are today's interest rates and why do they matter? To. Having a credit card with a low interest rate can be beneficial if you wind up carrying a balance on your card. While carrying a balance isn't ideal, it can be. Contact a housing counselor to learn more. Credit score has a big impact on the rate you'll receive. Next steps: How to get the best interest rate on your. The average home buyer pays about % of the loan amount in closing fees. So, what's included in closing costs? Usually, you'll have a variety of fees such as. Best Low-Interest Personal Loans of September ; SoFi · · % to % ; LightStream · · % to % ; PenFed Credit Union. · % to %. Guaranteed Rate.: Best mortgage lender · Pennymac.: Best for FHA loans · Bank of America.: Best for national bank mortgages · Alliant Credit Union.: Best for. "The best thing you can do is to give yourself options." Get your documentation in order. Once you've found a home and are quoted a strong interest rate, you'll. When shopping around for mortgage rates, consider not only the interest rate Comparing loan details from multiple lenders will help you determine the best. lowest interest rates if you have a higher credit score. This sentiment is not exclusive to personal loans (it applies to pretty much any loan product or. How does the Federal Reserve affect mortgage rates? You'll need to aim for a credit score to qualify for the lowest conventional loan interest rates. Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast Her work has also appeared on some of the best-known media outlets. An adjustable-rate will accrue interest at a much lower rate at today's rates but has Presently, the lowest fixed interest rate on a fixed reverse mortgage is. Compare personal loan rates from top lenders for September ; LightStream · · Loan term. 2 - 7 years ; Upstart · · Loan term. 3, 5 years. Review current mortgage rates, tools, and articles to help choose the best option Does my credit score affect my mortgage rate? Yes, your credit score.

How Much Can I Afford For House Payment

How Much Can You Afford? · You can afford a home worth up to $, with a total monthly payment of $1, · Related Resources. What percentage of my income should go toward a mortgage? The 28/36 rule is an easy mortgage affordability rule of thumb. According to the rule, you should. Mortgage affordability calculator. Get an estimated home price and monthly mortgage payment based on your income, monthly debt, down payment, and location. How much money do you make each year? Rule of thumb says that your monthly home loan payment shouldn't total more than 28% of your gross monthly income. Gross. Enter your details below to estimate your monthly mortgage payment with taxes, fees and insurance. Not sure how much you can afford? Try our home affordability. According to the 28/36 rule, your mortgage payment should be no more than $1, (6, x ). When combined with your other debts (credit cards, car loans. Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income, expenses and specified mortgage rate. Want to know how much house you can afford? Use our home Explore how much house you can afford by entering your annual income or a fixed monthly payment. Ideally, borrowers should aim to spend 28% or less of their gross annual income on a mortgage. Monthly debt — Monthly debts impact how much of a mortgage you. How Much Can You Afford? · You can afford a home worth up to $, with a total monthly payment of $1, · Related Resources. What percentage of my income should go toward a mortgage? The 28/36 rule is an easy mortgage affordability rule of thumb. According to the rule, you should. Mortgage affordability calculator. Get an estimated home price and monthly mortgage payment based on your income, monthly debt, down payment, and location. How much money do you make each year? Rule of thumb says that your monthly home loan payment shouldn't total more than 28% of your gross monthly income. Gross. Enter your details below to estimate your monthly mortgage payment with taxes, fees and insurance. Not sure how much you can afford? Try our home affordability. According to the 28/36 rule, your mortgage payment should be no more than $1, (6, x ). When combined with your other debts (credit cards, car loans. Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income, expenses and specified mortgage rate. Want to know how much house you can afford? Use our home Explore how much house you can afford by entering your annual income or a fixed monthly payment. Ideally, borrowers should aim to spend 28% or less of their gross annual income on a mortgage. Monthly debt — Monthly debts impact how much of a mortgage you.

It states that a household should spend no more than 28% of its gross monthly income on the front-end debt and no more than 36% of its gross monthly income on. To get a rough estimate of what you can afford, most lenders suggest you spend no more than 28% of your monthly income — before taxes are taken out — on your. The best way to think about how much home you can afford is to consider what your maximum monthly mortgage can be. As a general rule of thumb, lenders limit. One rule of thumb for determining how much house you can afford is that your mortgage payment shouldn't exceed more than a third of your monthly income. First, a standard rule for lenders is that your monthly housing payment should not take up more than 28% of your gross monthly income. How much you can afford to spend on a home depends on several factors, including these primary factors: you and your co-borrower's annual income, down payment. If you're thinking of buying a house, you can use this simple home affordability calculator to determine how much you can afford based on your current. Lenders call this the. “front-end” ratio. In other words, if your monthly gross income is $10, or $, annually, your mortgage payment should be $2, To calculate your DTI, divide your total monthly debt payments by your gross monthly income. The resulting percentage is your debt-to-income ratio. Aim for a. How much home you can buy depends a lot on your current debt load: Your auto loans, student loans, and credit card minimum payments, for example. Lenders will. Our home affordability tool calculates how much house you can afford based on several key inputs: your income, savings and monthly debt obligations. Ideally, you don't want a mortgage payment – alongside any other recurring debts – to be more than 50% of your monthly income. It is also wise to have some. How to calculate annual income for your household In order to determine how much mortgage you can afford to pay each month, start by looking at how much you. If you put less than 20% down on a home, your monthly payment will also include private mortgage insurance (PMI) to help protect the lender in case you stop. To determine how much you can afford for your monthly mortgage payment, just multiply your annual salary by and divide the total by This will give you. Your total housing costs should not be more than 28% of your gross monthly income. Your total debt payments should not be more than 36%. Debt-to-income-ratio . How much house can I afford if I make $50,, $70,, or $, a year? As noted in our 28/36 DTI rule section above, multiplying your gross monthly income. Most financial advisors recommend spending no more than 25% to 28% of your monthly income on housing costs. Add up your total household income and multiply it. Financial advisors recommend spending no more than 28% of your gross monthly income on housing and 36% on total debt. Using the 28/36 rule, if you earn. To determine how much house you can afford, use this home affordability calculator to get an estimate of the home price you can afford based upon your income.

Best Low Cost Stock Trading App

DEGIRO is Europe's fastest growing online stock broker. DEGIRO distinguishes itself from its competitors by offering extremely low trading commissions. eToro can be a great option for low-cost trading of stocks as they charge zero commission for stock trades and have zero hidden fees. platforms for Forex. Robinhood has made a splash, developing millions of devoted followers for its commission-free trading and user-friendly mobile app. Who are they best for? Invest in stocks and ETFs without commission when buying and selling shares. Instant online stock trading. Awarded best online trading app 3 years in a row. Voted Best Low Cost Broker (ADVFN International Financial Awards ). We offer over 68 major and minor currency pairs, a user-friendly app and a range of. Schwab's stock trading app for mobile devices help you stay connected to the markets. Place trades, monitor stocks, and take a custom watch list wherever. Sure thing! You could check out apps like Robinhood, M1 Finance, or Webull. All of these platforms offer commission-free trading, and they. Looking for an Indian Stock Market app with advanced features? Upstox is the one for you! Join Cr+ users growing their wealth right on Upstox! As a well-known discount broker, IBKR charges very low, competitive commissions for stocks and ETFs while commissions for forex and mutual funds are average. DEGIRO is Europe's fastest growing online stock broker. DEGIRO distinguishes itself from its competitors by offering extremely low trading commissions. eToro can be a great option for low-cost trading of stocks as they charge zero commission for stock trades and have zero hidden fees. platforms for Forex. Robinhood has made a splash, developing millions of devoted followers for its commission-free trading and user-friendly mobile app. Who are they best for? Invest in stocks and ETFs without commission when buying and selling shares. Instant online stock trading. Awarded best online trading app 3 years in a row. Voted Best Low Cost Broker (ADVFN International Financial Awards ). We offer over 68 major and minor currency pairs, a user-friendly app and a range of. Schwab's stock trading app for mobile devices help you stay connected to the markets. Place trades, monitor stocks, and take a custom watch list wherever. Sure thing! You could check out apps like Robinhood, M1 Finance, or Webull. All of these platforms offer commission-free trading, and they. Looking for an Indian Stock Market app with advanced features? Upstox is the one for you! Join Cr+ users growing their wealth right on Upstox! As a well-known discount broker, IBKR charges very low, competitive commissions for stocks and ETFs while commissions for forex and mutual funds are average.

Compare the fees and commissions charged by different trading apps to ensure you're getting the cost structure that fits you best. Some apps may charge monthly. Alpaca's easy to use APIs allow developers and businesses to trade algorithms, build apps and embed investing into their services. Buy, sell, and trade stocks online with a brokerage account from Wells Fargo Advisors WellsTrade. NinjaTrader offers exclusive software for futures trading. With our modern trading platform, you will control every step of your trading journey. Robinhood has commission-free investing, and tools to help shape your financial future. Sign up and get your first stock free. Limitations and fees may. Start investing online with SoFi. Enjoy commission-free trades and access to stock trading, options, auto investing, IRAs, and more. Start with just $5. What is the cheapest brokerage account? uSMART Securities offers life-time commission fee waiver for US Stock trading and commission fees waiver for HK Stock. More bang for your buck ; Min Investment; Transaction Fee ; Why Appreciate; ₹ 1; % or ₹5 whichever is higher ; other apps; ₹ 1; %. eToro is great for beginner & intermediate investors because it doesn't charge commissions on stock and ETF trades, has best-in-class copy trading features, a. The cheapest trading app in India is Edelweiss where an individual can trade, with just Rs per trade. Is trading safe? Yes, it is % safe to trade but. Robinhood helps you run your money your way. Trade stocks, options, ETFs, with Robinhood Financial & crypto with Robinhood Crypto, all with zero commission. Charles Schwab offers investment products and services, including brokerage and retirement accounts, online trading and more. Alpaca's easy to use APIs allow developers and businesses to trade algorithms, build apps and embed investing into their services. FYERS is one of the best trading platforms in India. It allows people to trade stocks easily without physical barriers and offers many advanced-level trade. Leading online trading solutions for traders, investors and advisors, with direct global access to stocks, options, futures, currencies, bonds and funds. E*TRADE from Morgan Stanley charges $0 commission for online US-listed stock, ETF, mutual fund, and options trades. Exclusions may apply and E*TRADE from Morgan. Freetrade is an excellent online trading platform that provides a cost-effective and user-friendly solution for those looking to trade shares. The platform. magicreels9.ru offers a set of financial tools covering a wide variety of global and local financial instruments. A one-stop-shop for traders and investors. Best Brokers is a realtime stock market game and crypto simulation focusing on fun. Enhance your knowledge of the stock market or test new trading. E*TRADE from Morgan Stanley charges $0 commission for online US-listed stock, ETF, mutual fund, and options trades. Exclusions may apply and E*TRADE from Morgan.

Should I Get Collision Insurance

Do I need comprehensive and collision insurance? Anyone who owns a car would be wise to have comprehensive and collision insurance. In some cases, a car owner. Generally, if you have a car loan or you're leasing a vehicle, comprehensive and collision coverage may be required by the lender, but they are otherwise. Unfortunately, without collision coverage, you will have to pay out of pocket for the property damage to your vehicle or even to replace your vehicle. If you. When your car gets damaged from a covered accident, these coverages may help pay for the repairs needed to get your car back into pre-accident condition. In the. When your car gets damaged from a covered accident, these coverages may help pay for the repairs needed to get your car back into pre-accident condition. In the. We now know that collision coverage will help protect you and your vehicle if you were to get into an accident with another vehicle or object, or a hit and run. The main benefits of collision insurance include saving money on repairs, being able to finance your car, coverage for a range of damage, and peace of mind. When it comes to buying car insurance, too many options make things confusing for someone generally unfamiliar with insurance lingo. Buying the best. If you couldn't afford to fix your car or buy a new one after a wreck, purchasing collision coverage could give you some peace of mind and keep you mobile. Do I need comprehensive and collision insurance? Anyone who owns a car would be wise to have comprehensive and collision insurance. In some cases, a car owner. Generally, if you have a car loan or you're leasing a vehicle, comprehensive and collision coverage may be required by the lender, but they are otherwise. Unfortunately, without collision coverage, you will have to pay out of pocket for the property damage to your vehicle or even to replace your vehicle. If you. When your car gets damaged from a covered accident, these coverages may help pay for the repairs needed to get your car back into pre-accident condition. In the. When your car gets damaged from a covered accident, these coverages may help pay for the repairs needed to get your car back into pre-accident condition. In the. We now know that collision coverage will help protect you and your vehicle if you were to get into an accident with another vehicle or object, or a hit and run. The main benefits of collision insurance include saving money on repairs, being able to finance your car, coverage for a range of damage, and peace of mind. When it comes to buying car insurance, too many options make things confusing for someone generally unfamiliar with insurance lingo. Buying the best. If you couldn't afford to fix your car or buy a new one after a wreck, purchasing collision coverage could give you some peace of mind and keep you mobile.

When your policy covers both liability and physical damage this is called a "full coverage" policy. One question that people often ask is, "Should I just get. Do I Need Collision Insurance? 73% of vehicle drivers purchase collision coverage because they want their car covered for repairs in the event of an accident. Collision insurance typically costs more than comprehensive coverage. And much like comprehensive, limits and deductibles apply to this coverage. Before you. Who needs Collision coverage? If you want to protect your vehicle from collisions with other vehicles or objects, you should choose Collision insurance. Some coverages are required if you finance or lease your car but not if it's paid off. Learn when to drop collision coverage and other optional coverages. One of the benefits of collision coverage is it will pay for those major repairs. All it takes is one accident to disable your car and leave you with repair. Collision insurance typically costs more than comprehensive coverage. And much like comprehensive, limits and deductibles apply to this coverage. Before you. Collision insurance isn't required by law in any state, but it can provide valuable coverage if you're in an accident. Collision insurance coverage helps pay for damage to your vehicle if you're at-fault in an accident or get into a fender bender with an object — like the. If your car is suddenly damaged or totaled, could you afford to repair or replace it? If the answer is no, you should get collision and comprehensive coverage. I always recommend comprehensive coverage to customers for a few reasons: * Less expensive than collision * Location and likelihood of. In Michigan, collision insurance is a coverage that will help pay your repair costs for accident-related car or truck damage. It is optional coverage and it. Some experts also advise dropping collision insurance when the vehicle is more than 10 years old. Since the average driver gets into an accident once every Collision coverage helps pay to fix or replace a car that's been damaged in a collision with another vehicle, object, or a rollover. Drivers are not required by law to have collision coverage, but it is a good idea to purchase this form of coverage. The state of Maryland does not require. Why should you buy collision coverage? · Can be used no matter who's at fault in the collision · Helps pay for the cost of repairs so you're not stuck paying the. Generally, if you have a car loan or you're leasing a vehicle, comprehensive and collision coverage may be required by the lender, but they are otherwise. Comprehensive auto insurance can help with non-crash-related damages, while collision auto coverage can save the day after a fender bender. Collision insurance is a good way to protect your car, but there may be times it doesn't make sense. Collision coverage isn't required by law, so if your. Do I need collision coverage? Collision insurance isn't required by law. Lenders may require collision coverage if your car is being financed or leased, but.

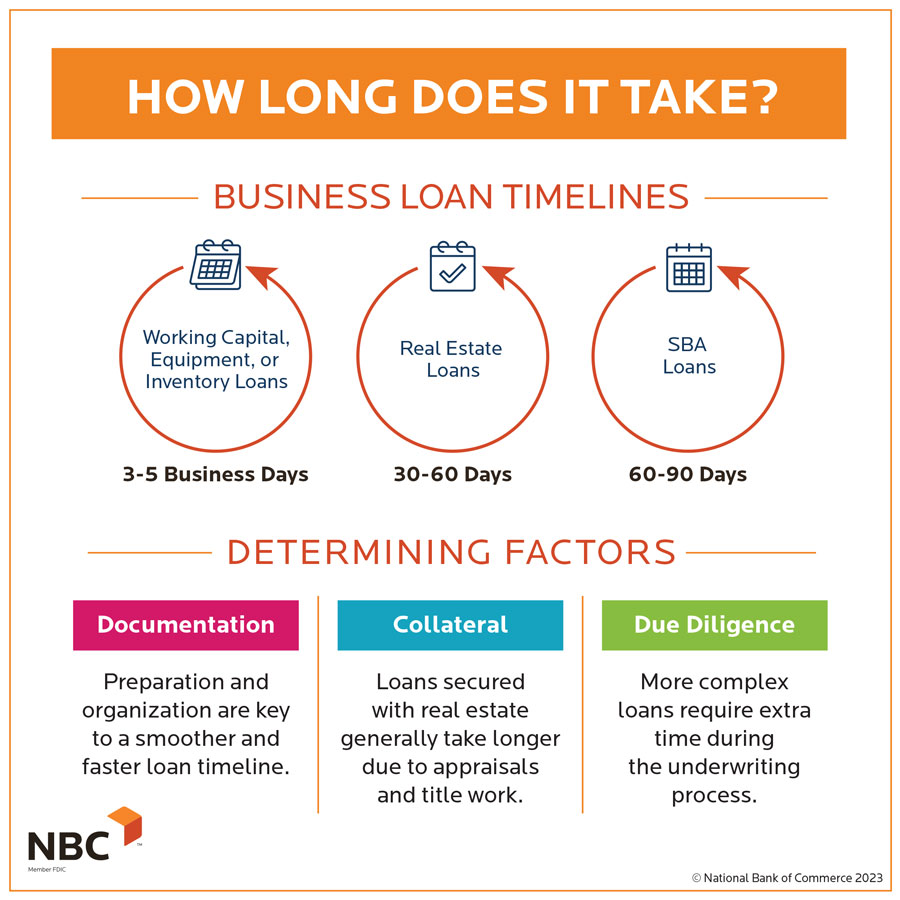

How Long Are Small Business Loans For

Loan terms range from 17 to 52 weeks depending on your eligibility and loan amount. Get funding fast. If approved, agree. SBA loans are suitable for businesses that need financing for long-term investments, such as purchasing real estate or expanding their operations. SBA loans are. The maximum length of the loan is 25 years for real estate and up to 10 years for working capital, inventory, equipment, or other business assets. The maximum. Flexible Financing Options for Small Businesses · Funding as soon as 5 business days · Loan amounts starting at $25, · Longer terms, up to 10 years. Choose the term of your loan (up to 75 months). Get up to % financing available, plus 10% for soft costs. Choose short term business loans to provide your business with a temporary capital influx, and close out the loan in 12 to 18 months. Equipment Financing Loans. To qualify for these long-term business loans, you work with banks and other lenders, approved by the U.S. Small Business Administration. The typical repayment. A long-term business loan is a type of business loan with a relatively long repayment period, typically spanning three to 10 years. Some long-term business. Loan amount: From $25, ; Interest rate: As low as % ; Loan terms: revolving with annual renewal ; Qualifications: Minimum 2 years in business under existing. Loan terms range from 17 to 52 weeks depending on your eligibility and loan amount. Get funding fast. If approved, agree. SBA loans are suitable for businesses that need financing for long-term investments, such as purchasing real estate or expanding their operations. SBA loans are. The maximum length of the loan is 25 years for real estate and up to 10 years for working capital, inventory, equipment, or other business assets. The maximum. Flexible Financing Options for Small Businesses · Funding as soon as 5 business days · Loan amounts starting at $25, · Longer terms, up to 10 years. Choose the term of your loan (up to 75 months). Get up to % financing available, plus 10% for soft costs. Choose short term business loans to provide your business with a temporary capital influx, and close out the loan in 12 to 18 months. Equipment Financing Loans. To qualify for these long-term business loans, you work with banks and other lenders, approved by the U.S. Small Business Administration. The typical repayment. A long-term business loan is a type of business loan with a relatively long repayment period, typically spanning three to 10 years. Some long-term business. Loan amount: From $25, ; Interest rate: As low as % ; Loan terms: revolving with annual renewal ; Qualifications: Minimum 2 years in business under existing.

A term loan provides funding for small businesses in a single lump sum. Maximum loan amounts typically exceed those offered by a line of credit or cash advance. $ billion. Small business loans supported since FY Finance Center for 3 years where she assisted California small businesses with accessing capital. SBA loans in New Jersey go up to 25 year terms and have below-market interest rates that are updated each month, while SBA 7(a) loan interest rates are. Flexible loan terms. Depending on how the loan is used, you can have terms ranging from 7 to 25 years. For-profit businesses only. Long-term business loans have loan terms that can last 5 to 25 years. The exact term depends on the lender, loan type, and borrower's creditworthiness. SBA loans to provide long-term loans and equity investments to qualifying small businesses. Links & Contact Info. Visit: “Is SBIC Financing Right for your. Commonly used to finance fixed assets, like equipment or vehicles, or to finance permanent working capital or long-term needs. Term loan amounts range from. Smaller-size loans of up to $50, provided through SBA funding intermediaries. Maximum repayment term allowed for an SBA microloan is seven years. Make a BIG difference with a short-term small business loan Having access to fast funding is ideal for business owners who need to get through temporary. Borrowers of short-term business loans typically must pay off their total loan amount in less than 12 months, but repayment terms can range up to about Long-term loans can last anywhere from 3 years up to 25 years. What Is The Difference Between a Loan and a Term Loan? The main term loan definition. loan program of the Small Business Administration's (SBA) business loan programs. The loan program provides long-term, fixed rate financing for. In general, approval for the SBA CDC/ loans can take anywhere from one to six months. Plus, once the lender approves the loan, the business may have to wait. Fixed or variable interest rates with flexible terms, up to 25 years depending on the purpose of the loan. No balloon payments. The option of financing closing. Best for businesses that want an unsecured term loan, with a simplified application and decisioning process. According to the SBA, the 7(a) loan is often the best option when real estate is part of a business purchase, but it can also be used for: short- and long-term. SBA loans are suitable for businesses that need financing for long-term investments, such as purchasing real estate or expanding their operations. SBA loans are. Find the Right Loan for Your Business! ; Up to 7 years for working capital, 10 years for equipment, and 25 years for real estate. · Up to 20 years on Real Estate. SBA Express Loan Program · Loans available from $25, and up to $, · Fixed rate terms up to years · Variable rates available for revolving period. Real estate loans have maximum maturity of 25 years. These are the maximum terms. The bank may request shorter terms. Use of Proceeds. A business may borrow for.

New Ipo On Nasdaq

Detailed information the last IPOs (initial public offerings) on the stock market. Includes IPO prices, dates, total returns and more. Stock Price Index - Real Time Values · Daily Publication, etc., Concerning For the latest IPO figures, please refer to "Overview of IPO". Overview of. Explore the latest news and insights on the stock market, earning updates and upcoming IPOs to get coverage on companies going public. The latest news coverage on initial public offerings, or IPOs, from MarketWatch. Get the latest coverage on companies entering the stock market. Though direct listings offer certain advantages over traditional initial public offerings (IPOs), the prohibition on raising new capital has significantly. Recently, we celebrated years of the New York Bankers Association at Nasdaq Marketsite! stopped by @Nasdaq to celebrate their IPO. Congrats on the. Learn which companies are planning to go public soon, and when they are scheduling their IPOs. Participating in a new IPO through Schwab allows you to potentially purchase stock at the IPO price. The IPO price is determined by the investment banks hired. Analyze the performance of IPOs listed on Nasdaq. Track post-IPO stock prices, trends, and market impact. Detailed information the last IPOs (initial public offerings) on the stock market. Includes IPO prices, dates, total returns and more. Stock Price Index - Real Time Values · Daily Publication, etc., Concerning For the latest IPO figures, please refer to "Overview of IPO". Overview of. Explore the latest news and insights on the stock market, earning updates and upcoming IPOs to get coverage on companies going public. The latest news coverage on initial public offerings, or IPOs, from MarketWatch. Get the latest coverage on companies entering the stock market. Though direct listings offer certain advantages over traditional initial public offerings (IPOs), the prohibition on raising new capital has significantly. Recently, we celebrated years of the New York Bankers Association at Nasdaq Marketsite! stopped by @Nasdaq to celebrate their IPO. Congrats on the. Learn which companies are planning to go public soon, and when they are scheduling their IPOs. Participating in a new IPO through Schwab allows you to potentially purchase stock at the IPO price. The IPO price is determined by the investment banks hired. Analyze the performance of IPOs listed on Nasdaq. Track post-IPO stock prices, trends, and market impact.

IPO Pulse Index. The new Nasdaq IPO Pulse Index functions as a leading indicator for the IPO Market by forecasting the direction of US IPO activity over the. One of the key requirements for a Nasdaq IPO is meeting certain financial benchmarks. This includes a minimum of $5 million in stockholders' equity and a. Q: What is the IPO Cross? NASDAQ's new IPO Cross, similar to the Opening and Closing CrossesSM, is an open auction process in which investors have the. IPO Stock Of The Week Hamilton Insurance (HG) is falling back to its latest buy point after hitting an all-time high in late August. The insurance leader is. An IPO calendar with upcoming initial public offerings (IPOs) on the stock market. Includes IPO dates, prices, how many shares are offered and more. Small Caps' upcoming IPOs page offers investors a preview of companies that are currently planning to list on the ASX (Australian Stock Exchange). Nasdaq has been a leader in the exchange space with our IPO execution that provides transparency & efficiency through proprietary technology. IPO Calendar ; Sep 10, , Trident Digital Tech Holdings Ltd (TDTH), NASDAQ, M · An initial public offering (IPO) or stock launch is a public offering in which shares of a company are sold to institutional investors and usually also to. Stockholm IPO Pulse expands our data-driven approach to anticipating IPO activity beyond the U.S. to another market where Nasdaq plays a central role in the. Learn more about upcoming IPOs at The New York Stock Exchange, which has a + year track record of supporting IPOs and innovating in the capital markets. At Nasdaq our “Modern Day IPO” process leverages data and technology to open IPOs electronically and remotely. Even when physical trading floors were closed. Upcoming US IPOs · Intel (estimated market cap: $ billion) · Shein (estimated market cap: $66 billion) · Databricks (estimated market cap: $43 billion) · Revolut. Nasdaq welcomed 33 equity new listings (among them 23 initial listings), raising a total of EUR million. · Ten companies switched from Nasdaq First North. Initial Public Offerings (IPOs). Eligible Fidelity customers are welcome to participate in new issue offerings, including initial public offerings (IPOs) as. () · Company Overview · Company Description · Company Financials · Company Filings · Experts · Headlines for Upcoming IPOs · Your symbols have been updated · Edit. Europe News · UK launches new listing rules in bid to boost growth for London's stock exchange. Thu, Jul 11th China Economy · Hong Kong's IPO market is. IPO Scorecard - September 14, ; Number Up: 55 ; Number Down: 58 ; Number Unchanged: 2 ; Total Return From Issue Price: % ; The Nasdaq Composite Index. IPO Calendar ; Cuprina Holdings (Cayman) Ltd · CUPR, Network 1 Financial Securities, , ; Flewber Global · FLAI, EF Hutton, , initial public offerings (IPOs). This list of Chinese companies was compiled using information from the New York Stock Exchange, NASDAQ, commercial.

Taxbit Invest

TaxBit, which offers cryptocurrency tax automation software targeted for crypto users, exchanges, and merchants, is excited to announce new investments. In addition to our partnership with TaxBit, this year Cash App is helping you calculate your gains and losses associated with your bitcoin transactions on. TaxBit is a tax and accounting enterprise solution for the tokenized economy. TaxBit's platform serves the industry's top exchanges, institutional investors. TaxBit. 2. Generate tax Form These services will determine your capital gains and generate a Form PDF. 3. Prepare and e-file on FreeTaxUSA. Enter. TaxBit is a cryptocurrency tax and accounting software that automates tax calculations and reporting on cryptocurrency transactions. Strategic Investment TaxBit received a strategic investment from In-Q-Tel, a notable investor for the U.S. national security community, indicating a strong. See TaxBit funding rounds, investors, investments, exits and more. Evaluate their financials based on TaxBit's post-money valuation and revenue. Anchorage Digital + TaxBit = Registered Investment Advisor (RIA) with industry leading compliance Sign up today and discover all the ways TaxBit can work for. Buy and sell TaxBit stock. Get stock prices & access to pre-IPO shares in one place at Hiive. TaxBit, which offers cryptocurrency tax automation software targeted for crypto users, exchanges, and merchants, is excited to announce new investments. In addition to our partnership with TaxBit, this year Cash App is helping you calculate your gains and losses associated with your bitcoin transactions on. TaxBit is a tax and accounting enterprise solution for the tokenized economy. TaxBit's platform serves the industry's top exchanges, institutional investors. TaxBit. 2. Generate tax Form These services will determine your capital gains and generate a Form PDF. 3. Prepare and e-file on FreeTaxUSA. Enter. TaxBit is a cryptocurrency tax and accounting software that automates tax calculations and reporting on cryptocurrency transactions. Strategic Investment TaxBit received a strategic investment from In-Q-Tel, a notable investor for the U.S. national security community, indicating a strong. See TaxBit funding rounds, investors, investments, exits and more. Evaluate their financials based on TaxBit's post-money valuation and revenue. Anchorage Digital + TaxBit = Registered Investment Advisor (RIA) with industry leading compliance Sign up today and discover all the ways TaxBit can work for. Buy and sell TaxBit stock. Get stock prices & access to pre-IPO shares in one place at Hiive.

Learn about IVP's investment in TaxBit, the leading tax and accounting software provider for the digital economy. Explore our fintech portfolio. TaxBit focuses on the Finance sector. Explore the world of Startups and Venture Investing at OurCrowd. Tax-Prep Software for Business Income Tax (BIT) Filers. Participation in the Invest in Kids · Lien Registry · Tax Rate Database. Related Sites. State of. TaxBit is backed by and partnered with the world's leading investors in cryptocurrency and fintech. TaxBit's Investors. PayPal. Sapphire Ventures. Valar. TaxBit is a cryptocurrency tax and accounting software that automates tax calculations and reporting on cryptocurrency transactions. TaxBit is the modern Tax and Accounting Solution for the digital economy. Sign up today for more details and to buy or sell Taxbit Stock. OrbiMed Raises $B Across Private Investment Funds to Invest in Healthcare Gunderson Dettmer Client Tactic Acquired by TaxBit · ThinkLabs AI Launches. TaxBit Stock. TaxBit provides a SaaS platform that automates tax calculations and reporting on cryptocurrency transactions. It helps retail investors and. TaxBit and TAINA Partner to Offer a TAINA clients include the world's largest global financial institutions, private equity firms, investment. Dive into essential tax insights for your crypto investments. Discover expert advice from @TaxBitMiles in his interview with @CNNBusiness. As a result of the landmark Infrastructure Investment and Jobs Act of , crypto brokers will soon be required to collect and report significantly more. The TaxBit Accounting Suite is the the premier enterprise-grade digital asset accounting platform enabling trust, auditability, and confidence. TaxBit is a cryptocurrency tax and accounting software that automates tax calculations and reporting on cryptocurrency transactions. TaxBit Inc Lobbying by Industry. Export to CSV. Industry, Total. Securities & Investment, $, NOTE: Figures on this page are calculations by OpenSecrets. TaxBit is one of the best options when it comes to cryptocurrency tax software platforms and its backed by some of the biggest names in the crypto investment. File your crypto taxes knowing you're getting % accurate calculations - % of · *TurboTax Investor Center does not provide investment advice, and is. PubSec Transaction Detail. Security and Privacy. Protection you can rely on We're deeply invested in infrastructure privacy, never take unnecessary. As the first and only company to build real-time ERP accounting software for commodities, equities, and other digital asset investments, TaxBit provides. Information on valuation, funding, cap tables, investors, and executives for TaxBit. Use the PitchBook Platform to explore the full profile. Private Equity investments involve a high degree of risk. Potential investors must have the financial capacity and willingness to bear the risks associated with.

Eur To Usd Fx

Download Our Currency Converter App ; 1 EUR, USD ; 5 EUR, USD ; 10 EUR, USD ; 20 EUR, USD. Suggested Citation: Board of Governors of the Federal Reserve System (US), U.S. Dollars to Euro Spot Exchange Rate [DEXUSEU], retrieved from FRED, Federal. US dollar (USD). ECB euro reference exchange rate. 5 September EUR 1 = USD (%). Change from 5 September to 5 September Min (3. Check live exchange rates for 1 EUR to USD with our EUR to USD chart. Exchange euros to US dollars at a great exchange rate with OFX. EUR to USD trend. Euros to US Dollars conversion rates ; 1 USD, EUR ; 5 USD, EUR ; 10 USD, EUR ; 25 USD, EUR. EURUSD FX Cross Rate - foreign exchange rates comparison and historical charts. EUR/USD is the FX ticker for the exchange rate between the US dollar and the euro. It tells traders how many US dollars are needed to buy a single euro. USD/EUR. 3. 5 ; USD/JPY. 0. 1 ; JPY/USD. 0. 0 ; XAU/USD. 0. 0. At the time of writing, €1 EUR is worth $ USD. Once you know that information, multiply the amount you have in USD by the current exchange rate. The. Download Our Currency Converter App ; 1 EUR, USD ; 5 EUR, USD ; 10 EUR, USD ; 20 EUR, USD. Suggested Citation: Board of Governors of the Federal Reserve System (US), U.S. Dollars to Euro Spot Exchange Rate [DEXUSEU], retrieved from FRED, Federal. US dollar (USD). ECB euro reference exchange rate. 5 September EUR 1 = USD (%). Change from 5 September to 5 September Min (3. Check live exchange rates for 1 EUR to USD with our EUR to USD chart. Exchange euros to US dollars at a great exchange rate with OFX. EUR to USD trend. Euros to US Dollars conversion rates ; 1 USD, EUR ; 5 USD, EUR ; 10 USD, EUR ; 25 USD, EUR. EURUSD FX Cross Rate - foreign exchange rates comparison and historical charts. EUR/USD is the FX ticker for the exchange rate between the US dollar and the euro. It tells traders how many US dollars are needed to buy a single euro. USD/EUR. 3. 5 ; USD/JPY. 0. 1 ; JPY/USD. 0. 0 ; XAU/USD. 0. 0. At the time of writing, €1 EUR is worth $ USD. Once you know that information, multiply the amount you have in USD by the current exchange rate. The.

See the latest price data and market sentiment for the euro against the US dollar and spot trading opportunities. EUR/USD is one of the major forex pair. Dive into historical exchange rates for EUR to USD with Wise's currency converter. Analyse past currency performance, track trends, and discover how. You will notice that the FX rate has ranged between and during that time period. That range is basically from near parity – almost a exchange. EUR/USD exchange rate. Charts, forecast poll, current trading positions and technical analysis. Keep informed on EUR/USD updates. The current rate of EURUSD is USD — it has increased by % in the past 24 hours. See more of EURUSD rate dynamics on the detailed chart. Euro to US Dollar conversion rate Exchange Rates shown are estimates, vary by a number of factors including payment and payout methods, and are subject to. Find the latest EUR/USD (EURUSD=X) stock quote, history, news and other vital information to help you with your stock trading and investing. MSN. 1 day ago. EUR/USD: Weak Labor Market Data Could Catapult the Pair Toward Barrier ; Benzinga. 3 hours ago. EUR/USD Maintains Neutral Stance Ahead Of US. The euro-to-dollar exchange rate fluctuated significantly in , reaching its lowest recorded value since during that time. EUR to USD currency chart. XE's free live currency conversion chart for Euro to US Dollar allows you to pair exchange rate history for up to 10 years. Get live updates on the EUR/USD rate with the interactive chart. Read the latest EUR/USD forecasts, news and analysis provided by the DailyFX team. The EUR/USD (or Euro Dollar) currency pair belongs to the group of 'Majors', a way to mention the most important pairs in the world. This group also includes. CME FX Link connects OTC FX and FX futures with one Globex spread, so you can add efficiency and better manage FX exposures. Euros to US Dollars conversion rates ; 1 USD, EUR ; 5 USD, EUR ; 10 USD, EUR ; 25 USD, EUR. EUR to USD | historical currency prices including date ranges, indicators, symbol comparison, frequency and display options for Euro. This Free Currency Exchange Rates Calculator helps you convert Euro to US Dollar from any amount. Euro to United States dollar (EUR to USD). Quickly and easily calculate foreign exchange rates with this free currency converter. The EURUSD increased or % to on Thursday September 5 from in the previous trading session. Euro US Dollar Exchange Rate - EUR/USD. Find the current Euro US Dollar rate and access to our EUR USD converter, charts, historical data, news, and more.

1 2 3 4 5