magicreels9.ru

News

How To Make A Quick Cash

Create websites and sell them on the internet. · Do small tasks on Fiverr, Latium, Pico worker so on.. · Start a youtube channel. · Write blog. You might do bigger things like starting a blog or investing. You might do online tasks or even make real money playing games. Or you can use cash-back apps or. Earn real money by completing simple tasks with the app. Easily make money by completing surveys, giving opinions, testing services,.. To earn money. Apply online for a quick lending decision and if approved, receive instant cash. Speedy Cash offers a variety of fast loans to meet your cash needs. Make purchases with your debit card, and bank from almost anywhere by phone, tablet or computer and more than 15, ATMs and more than 4, branches. Savings. Quick Cash products are inexpensive items like bottled water, towels, or mat rentals that can be sold without leaving the Class Sign In screen. They are. 7 Smart Ways to Raise Cash Fast · 1. Liquidate Your Assets · 2. Take on Odd Jobs · 3. Track Down Loose Change · 4. Organize a Garage Sale · 5. Tap Your Retirement. 7 Quick Ways to Make Money Investing $1, If you're shrewd, you can turn one thousand bucks into even more money. Here's how to make money on investments. How to Make Money from Home: 23 Proven Ways · 3. Become an online tutor. If you know a subject well or are a native English speaker, you can sign up with an. Create websites and sell them on the internet. · Do small tasks on Fiverr, Latium, Pico worker so on.. · Start a youtube channel. · Write blog. You might do bigger things like starting a blog or investing. You might do online tasks or even make real money playing games. Or you can use cash-back apps or. Earn real money by completing simple tasks with the app. Easily make money by completing surveys, giving opinions, testing services,.. To earn money. Apply online for a quick lending decision and if approved, receive instant cash. Speedy Cash offers a variety of fast loans to meet your cash needs. Make purchases with your debit card, and bank from almost anywhere by phone, tablet or computer and more than 15, ATMs and more than 4, branches. Savings. Quick Cash products are inexpensive items like bottled water, towels, or mat rentals that can be sold without leaving the Class Sign In screen. They are. 7 Smart Ways to Raise Cash Fast · 1. Liquidate Your Assets · 2. Take on Odd Jobs · 3. Track Down Loose Change · 4. Organize a Garage Sale · 5. Tap Your Retirement. 7 Quick Ways to Make Money Investing $1, If you're shrewd, you can turn one thousand bucks into even more money. Here's how to make money on investments. How to Make Money from Home: 23 Proven Ways · 3. Become an online tutor. If you know a subject well or are a native English speaker, you can sign up with an.

In under 60 seconds, you can get money when you need it most, deposited right into your account; no credit check required! Quick Cash Loans can help you build. Get instant access to funds with Quick Cash Loans from AMUCU in Utah. Enjoy fast approval, no credit checks, and flexible terms. Apply for your loan today! Highlights: OfferUp is often compared to Craigslist, but some users claim it's an easier site to post on. If you download the app, you can send instant messages. Quick Cash (QCash) is an alternative solution for emergencies instead of going to a cash advancement institution. The process is fast, easy. Article writing is a very easy way to generate some fast cash in your account the same day. I love flipping sites and do the same flip about 1 per week for $ You may have heard about our Quick Cash Loans and wondered how they are different from a personal loan. Well, we are here to clear the air and give you more. QuickCash · Borrow between $ - $ in just a few clicks in online banking · Fixed-rate and term up to 48 months* that works for you · No credit check required. How can I get money now? 12 top options · 1. Cash advances · 2. Consider exploring personal loans · 3. Credit builder loan · 4. Borrow money from family and. If you're looking for quick money, yard sales have been extremely popular since your grandparent's day (Yard Sales, Garage Sales, Estate Sales are all pretty. In under 60 seconds, you can apply to get money when you need it most. Quick Cash Loans are deposited right into your account; no credit check required! Side hustles: How to earn extra cash online · 1. Start an online shop · 2. Good at cooking and baking? Offer a catering service · 3. Sell your photography · 4. Take. Creating content on YouTube is a fast-track side hustle, especially compared with blogging. It's easier to “rank” videos for your target keywords, and once your. About this app. arrow_forward. ☆ MAKE MONEY by doing easy tasks! Earn real money by completing simple tasks inside the app. Easily make free money by. How to Make Money Quick [$$$ in One Day or Less] · Uber Instant Pay offers quick cash, $ fee per transaction. · Sell stuff online or offline for quick, easy. Flog on eBay for best prices · Sell on Vinted with no fees · Sell for free on Facebook · Get quick cash for old CDs, games & more · Flog tech 'leftovers', such as. Sell at one of ecoATM's thousands of kiosks and get instant cash. Use the site to find one near you. They're located in Walmart stores, Kroger supermarkets. Check Advance Loans We'll give you cash, and you can pay us back on your next payday, with no credit checks. You can use that money to meet emergency needs or. Whether you need a little extra cash for bills, groceries, an emergency car repair, or anything in between, a QCash (Quick Cash) Loan can help. Get money. Get the money you need today, start building credit, and set yourself up for a bright financial future. GET STARTED WITH BRIGIT: 1. Download Brigit 2. Get the quick cash you need with PD Quick Cash loans. No credit checks, waiting periods, or application fees. Apply now!

What Does Stash Invest In

With Stash's investing account, you can choose from a large selection of ETFs and individual stocks starting from the entry tier. That means you'll need to know. Stash is a subscription-based personal finance app. The company has partnerships with Mastercard, Stride Bank, Marqeta, Mambu, and Alloy. As of February The Stash brokerage account has no commission fees, so you won't have to pay a broker for buying or selling your investments, which are covered up to $, How they describe themselves: Stash is a mobile-first investment platform that helps simplify investing through education and an intuitive user experience. Stash is a personal finance app for newbie investors, with great educational tools and a low minimum required deposit. Unfortunately, its fees run a bit high. Stash is designed to educate you on how to start investing using a portfolio of ETFs and a limited selection of individual stocks like Apple, Alphabet (Google). The company operates both a web platform and mobile apps, allowing users to incrementally invest small amounts, commonly known as micro-investing. It also. Smart Portfolio is the fully automated investment strategy where you turn over the management to Stash. Stash reviews your account quarterly for rebalancing. Investment advisory services offered by Stash Investments LLC, an SEC registered investment adviser. Investing involves risk and investments may lose value. With Stash's investing account, you can choose from a large selection of ETFs and individual stocks starting from the entry tier. That means you'll need to know. Stash is a subscription-based personal finance app. The company has partnerships with Mastercard, Stride Bank, Marqeta, Mambu, and Alloy. As of February The Stash brokerage account has no commission fees, so you won't have to pay a broker for buying or selling your investments, which are covered up to $, How they describe themselves: Stash is a mobile-first investment platform that helps simplify investing through education and an intuitive user experience. Stash is a personal finance app for newbie investors, with great educational tools and a low minimum required deposit. Unfortunately, its fees run a bit high. Stash is designed to educate you on how to start investing using a portfolio of ETFs and a limited selection of individual stocks like Apple, Alphabet (Google). The company operates both a web platform and mobile apps, allowing users to incrementally invest small amounts, commonly known as micro-investing. It also. Smart Portfolio is the fully automated investment strategy where you turn over the management to Stash. Stash reviews your account quarterly for rebalancing. Investment advisory services offered by Stash Investments LLC, an SEC registered investment adviser. Investing involves risk and investments may lose value.

Welcome back! Log in to your Stash account. With Stash, you get a digital banking account with a debit card that rewards you with pieces of stock when you make purchases at well-known public companies. With Stash, you get a digital banking account with a debit card that rewards you with pieces of stock when you make purchases at well-known public companies. We're helping everyday Americans invest and build wealth. (magicreels9.ru) | Stash is a personal finance app that makes investing easy. Stash is a good app (and I love it) if you're a "retail investor," meaning you're investing for the long term. Yet, if you want to withdraw, you. A fast-growing investing app called Stash is trying to make money by making investing enjoyable again. Its co-founders, Brandon Krieg and Ed Robinson, say. Stash is an investing app that lets you pick your own stocks and ETFs, or take an automated hands-off approach. Best for. New investors; Young investors. Stash is a personal finance app for newbie investors, with great educational tools and a low minimum required deposit. Unfortunately, its fees run a bit high. Stash is an online platform which offers three types of investment accounts: personal brokerage accounts, retirement accounts and custodial investment accounts. Stash is a personal finance app that helps make investing easy and affordable for millions of Americans. Stash's subscription plans are designed to help. Stash. likes · talking about this. Our vision is to turn money into a source of hope and opportunity. Stash's robo-advisor ranked #1 for About. Stash develops a personal finance application to combine banking, investing, and advice into one platform. Stash's app offers fractional investing in stocks and ETFs, IRAs, checking accounts and a debit card that rewards purchases with fractional shares back for a. We're helping everyday Americans invest and build wealth. (magicreels9.ru) | Stash is a personal finance app that makes investing easy. What industry is Stash Financial in? Stash Financial's primary industry is Financial Software. Is Stash Financial a private or public company? Stash Financial. Stash is an investment that helps you invest in your future, tax free, by saving small amounts of money every day via an app. You can stash automatically from. BrokerCheck is a trusted tool that shows you employment history, certifications, licenses, and any violations for brokers and investment advisors. Once your investment profile type is known, Stash offers you value-based investment options. You can select a custom portfolio that is based on your interests. r/stashinvest: This is the Stash community on reddit. Come talk about Stash, investing, and personal finance. New? Take a few minutes to read our. Stash Investments LLC provides software solutions. The Company offers personalized guidance tool to invest in stocks based on expense ratio.

How To Not Pay Earnin Back Reddit

I have been on earnin for months and always paid back my measly $50 advance on time. I usually have about $ a month deposited in my account. So I started using EarnIn and empower now I have no choice but to keep using it so my checks aren't super short and I have enough money to. Call your bank and tell them to put a stop payment to all things Earnin. They might charge $30 or so depending on who you bank with, but it's worth it. Even though today is payday and I paid back my balance (and have always had location tracking on) I don't have any earning available! Anyone ever have this. This app became successful because they guaranteed that they would not require payment for the payday advances they offer. How can I pay EarnIn back? When I transfer out, will I be debited on the My payday and debit date are not the same · Why does the EarnIn app say that. App is deleted and we have $ of our own money on pay day. Glad to finally be free of this vicious cycle after 2 years! I have an Earnin account and I'm $10 short on paying them back tomorrow and there is no other money in my account to cover the rest of the balance. For anyone trying to revoke. They're legally not allowed to persecute you for not paying back. I have been on earnin for months and always paid back my measly $50 advance on time. I usually have about $ a month deposited in my account. So I started using EarnIn and empower now I have no choice but to keep using it so my checks aren't super short and I have enough money to. Call your bank and tell them to put a stop payment to all things Earnin. They might charge $30 or so depending on who you bank with, but it's worth it. Even though today is payday and I paid back my balance (and have always had location tracking on) I don't have any earning available! Anyone ever have this. This app became successful because they guaranteed that they would not require payment for the payday advances they offer. How can I pay EarnIn back? When I transfer out, will I be debited on the My payday and debit date are not the same · Why does the EarnIn app say that. App is deleted and we have $ of our own money on pay day. Glad to finally be free of this vicious cycle after 2 years! I have an Earnin account and I'm $10 short on paying them back tomorrow and there is no other money in my account to cover the rest of the balance. For anyone trying to revoke. They're legally not allowed to persecute you for not paying back.

Let me preface this by saying, I've been an Earnin user for approximately 6 months. Ive paid back my money every paypay. If you're unable to do a side hustle/part time job then just revoke the automatic payments from your account by emailing them. If you can't do. pay it forward to the next person who replies under us, and so on Will boost back asap! Can anyone in the EarnIn Community help me. Update: Still no paycheck yet. IF I get my money, you can bet I'm never using this app again and changing direct deposit to my actual bank. Order a stop payment from your bank. This is very simple to do, just contact your bank, or use your mobile banking app if it has the feature to. If you read the terms of service it says there is no obligation to pay it back. You can take out a loan and then revoke ACH authorization and. How do I stop earnin from taking the money out of my account..I have an emergency and can't afford to have it taken out first thing on payday. Has anyone ever had an issue with their reset? I paid everything back and my reset did not happen. It still shows my max limit but my daily earnings are not. If you don't pay it, they'll send you to collections and it will destroy your credit. These apps are incredibly predatory. I stopped using them. If you are stuck in this cycle, you can tell your bank to revoke Earnin's authorization to your account. Since they claim to not be a payday. I really don't recommend anyone use the Earnin service, or if you do, immediately tell your bank to put in a stop order of payment afterwards. pay it back and they can't do anything to pursue you. While EarnIn doesn't engage in debt collection or report users to credit agencies. Call your bank to put a stop charge on earnin and dispute the charge. I just stopped paying these mfs back since they'd pull similar shit. I looked into these apps and found none of them are enforceable debts. Earnin Klover Dave MoneyLion Brigit it's all unenforceable. They have no. It's been a while since I've seen this mentioned, but if you would like to stop Earnin from withdrawing from you simply chat with them and state. Promising a Boost for Boost and not boosting back is an auto ban. I don't care about their freaking pay max just give me what's mine! I. Nothing you can do about those except stop using them so you stop having to pay them back. Not sure why you'd prefer they go to collections. Earnin will no longer work for CT residents. Revoke your payment authorization so they can't take any money out of your bank account and close your account in. Dont feel bad. I got sucked into the cycle as well. I decided this must stop. So I put a stop payment on the apps and only allow myself to have.

How To Add A Credit Card To Cash App

:max_bytes(150000):strip_icc()/Cash_App_01-c7abb9356f1643a8bdb913034c53147d.jpg)

Tap the Money tab on your Cash App home screen; Press Add money; Choose an amount; Tap Add; Use Touch ID or enter your PIN to confirm. alt text. Keep in mind that you can only have one bank account and one debit card connected to your Cash App account. Link Cash App with your debit card. If you'd like to. How to Add a Credit Card to Your Cash App · Open the Cash App and tap the Banking tab. · Tap + Add Credit Card. · Enter your credit card. ¹ 55% of Cash App customers don't have a credit card,² allowing you to convert previously untapped customers. Remove friction at checkout. Enable your. Add cards and banks · Security and safety · Set up Direct Deposit · Add Use the PayPal Debit Card1 or app to add cash at retailers with 90,+ locations. To get started, open the Samsung Wallet app on your phone, and then tap the Quick access tab at the bottom. · Tap Add, and then tap Payment cards. · Tap Get a. Under “Linked Accounts” it usually gives you 3 options: Debit Card, Bank Account and then Credit Card. You may need a bank account AND debit. Add new card · Open the Google Wallet app. · At the bottom, tap Add to Wallet. · Tap Payment card. · Tap New credit or debit card. · At the bottom, tap Save and. I already have my debit card linked on my Cash App account but I need to send someone money using a credit card instead of my debit card but. Tap the Money tab on your Cash App home screen; Press Add money; Choose an amount; Tap Add; Use Touch ID or enter your PIN to confirm. alt text. Keep in mind that you can only have one bank account and one debit card connected to your Cash App account. Link Cash App with your debit card. If you'd like to. How to Add a Credit Card to Your Cash App · Open the Cash App and tap the Banking tab. · Tap + Add Credit Card. · Enter your credit card. ¹ 55% of Cash App customers don't have a credit card,² allowing you to convert previously untapped customers. Remove friction at checkout. Enable your. Add cards and banks · Security and safety · Set up Direct Deposit · Add Use the PayPal Debit Card1 or app to add cash at retailers with 90,+ locations. To get started, open the Samsung Wallet app on your phone, and then tap the Quick access tab at the bottom. · Tap Add, and then tap Payment cards. · Tap Get a. Under “Linked Accounts” it usually gives you 3 options: Debit Card, Bank Account and then Credit Card. You may need a bank account AND debit. Add new card · Open the Google Wallet app. · At the bottom, tap Add to Wallet. · Tap Payment card. · Tap New credit or debit card. · At the bottom, tap Save and. I already have my debit card linked on my Cash App account but I need to send someone money using a credit card instead of my debit card but.

Go to the Card tab on your Cash App home screen; Select Add to Google Pay; Follow the steps. Using Your Cash App Card for Contactless Purchases. Still waiting. Your Apple Cash balance lives on your Apple Cash card in the Wallet app. Card, and any other credit and debit cards that you add to Wallet. How do I. Free Cash Card debit card. ATM withdrawals. No account, maintenance, or annual fees. In-app bill pay. No-fee stock trades, buy and sell cryptocurrency. Cash App. Step 1: Add your Cash App Card to Google Wallet · Launch Google Wallet · Tap '+ Add to Wallet' · Select 'Payment Card' and then 'New credit or debit card' · Follow. Cash app does allow it's users to link a credit card to the platform. Learn more about linking a credit card to cash app. How do I add an authorized user to my card. You can add the following credit/debit cards to your account: American To get more info on Cash App Pay, refer to the app or Cash App Pay website. Under the "Cash & BTC" section, tap on the "Add Cash" option. 5. Enter the amount of money you want to add to your Cash App card. 6. Tap on the. Please help I really want to buy stuff with my cash app card - I'm not able to add a Payment method - add a credit/debit card. i was trying to. Want us to walk you through it? Show me how to enroll in Online Banking. What's a cash credit line? While Cash App typically requires a bank account, you can follow the 5 Unique Steps to add your credit card directly without linking a bank account. No you cannot unless you connect a debit card. Let me show you how to add credit card on cash app and if you can use credit card on cash app to send and transfer money without bank account. Cash App is the easy way to send, spend, save, and invest* your money. Download Cash App and create an account in minutes. SEND AND RECEIVE MONEY INSTANTLY. How to activate a Cash App card? · Open Cash App · Click on the Cash Card icon · Click 'Activate Cash Card' · Click 'OK' when Cash App requests permission to use. Take a Payment with Cash App Pay · 1. Add the Cash App Pay payment method to the page · 2. Get the payment token and attach it to a DOM element · 3. Process a Cash. You open your account by linking a debit card, but you can also add other debit cards or payment methods. It is similar to PayPal or Venmo in that way. Cash App. The Cash App Card is a free, customizable debit card that is connected to your Cash App balance. It can be used anywhere Visa is accepted, both online and in. Cash App Pay uses either the customer's Cash App balance or linked debit card to fund the transaction. Unlike cards, Cash App Pay does not support a. Customers who make a purchase on your Square Online site will see the option to pay with Cash App Pay during checkout. Square Payment Links.

Best Car Insurance If You Have A Dui

During this program, they may visit trauma facilities, morgues, or coroners' offices in order to see firsthand the consequences of drunk driving. How Long a DUI. DUI attorneys are specialists who keep up with the latest laws and regulations in Georgia on drunk driving and DUIs. A reasonable DUI attorney will know the. The cheapest car insurance companies after a DUI are State Farm, Travelers, and Progressive, according to WalletHub's analysis. A DUI conviction makes it harder. Safe driving should be rewarded. If your household hasn't had an accident, violation or major comprehensive auto insurance claim in three to five years, you. Filing an SR is required for drivers who have had their license suspended due to a DUI conviction. If you were a policyholder prior to the conviction, your. DUI and Car Insurance: What Happens Next? Insurance industry's answers to questions about the effects of a drunk driving conviction on insurance rates now and. At Progressive, you can likely still get insurance if you've had a DUI. Depending on the state, a DUI may be referred to as a DWI (driving while intoxicated). When a driver receives a DUI or DWI conviction, insurance companies view them as much more likely to get into car accidents, which leads to higher claims and. For insurers, a DUI, OWI or DWI conviction is among the most serious indicators of risky driving habits. For that reason, you can expect car insurance rates. During this program, they may visit trauma facilities, morgues, or coroners' offices in order to see firsthand the consequences of drunk driving. How Long a DUI. DUI attorneys are specialists who keep up with the latest laws and regulations in Georgia on drunk driving and DUIs. A reasonable DUI attorney will know the. The cheapest car insurance companies after a DUI are State Farm, Travelers, and Progressive, according to WalletHub's analysis. A DUI conviction makes it harder. Safe driving should be rewarded. If your household hasn't had an accident, violation or major comprehensive auto insurance claim in three to five years, you. Filing an SR is required for drivers who have had their license suspended due to a DUI conviction. If you were a policyholder prior to the conviction, your. DUI and Car Insurance: What Happens Next? Insurance industry's answers to questions about the effects of a drunk driving conviction on insurance rates now and. At Progressive, you can likely still get insurance if you've had a DUI. Depending on the state, a DUI may be referred to as a DWI (driving while intoxicated). When a driver receives a DUI or DWI conviction, insurance companies view them as much more likely to get into car accidents, which leads to higher claims and. For insurers, a DUI, OWI or DWI conviction is among the most serious indicators of risky driving habits. For that reason, you can expect car insurance rates.

Two southern states with highly punitive rates after a DWI-DUI are North Carolina and South Carolina. It is essential for anyone charged with any drunk driving. If you've been arrested for DWI in North Carolina, NC DUI Insurance can provide you with the lowest insurance rate possible. North Carolina drunk driving laws. If you are involved in a DUI, the policy you'll need to purchase is still the regular motor vehicle liability policy, but with monthly premium at times 3 to 5. 08% BAC for a DUI (driving under the influence) or DWI (driving while impaired/intoxicated). A DUI and DWI may seem like they're one and the same thing to most. The best place to start is with the insurers in our list of the cheapest car insurance for a DUI. USAA, Progressive and American Family all offer policies for. Will a drunk driving conviction impact my car insurance? A DUI conviction will raise your car insurance rates. It's a general truism about most situations in. vehicle insurance information. Vehicle Registration Suspensions. If DMV does not receive proof of insurance for a vehicle, we will suspend the vehicle's. USAA offers cheap car insurance for DUI drivers at $ per year, but it is only available to members of the U.S. military, veterans and eligible family members. If you are involved in a DUI, the policy you'll need to purchase is still the regular motor vehicle liability policy, but with monthly premium at times 3 to 5. Dealing With a DUI or DWI Charge · How to Fight a Drunk Driving Charge · DUI Laws and Penalties In Your State. If you caused a car accident while you were. Your premiums will probably rise after a DUI or DWI. It's important to carefully weigh your options to find the best rate in these challenging. "Drunk Driving." Experian. "How to Get Car Insurance After a DUI." Driving Laws (NOLO). "How Long Does a DUI/DWI Stay on Your Record?." Jamie Johnson. The best place to find them is at your local independent insurance agent's office. Do an internet search for “Independent Insurance Agent near. At Cost-U-Less, our bilingual and licensed agents are standing by to help you get back on the road after a DUI. We can help you find cheap car insurance with a. If you've been arrested for DWI in North Carolina, NC DUI Insurance can provide you with the lowest insurance rate possible. North Carolina drunk driving laws. A DUI will affect your insurance, driving record and may result in a criminal record. Typically, insurance companies will look back over a year period;. Will my insurance rates increase after a DUI in Virginia? Like traffic accidents and serious traffic violations, car insurance companies see a drunk driving. Each type of coverage is designed to protect you or your property. And, you're in the driver's seat when picking which vehicle coverages best fit your. If an insurer does offer auto insurance coverage to a DWI/DUI driver, your rate will not be cheap. Every carrier is different, as are their rates for a DUI. If you're found guilty of a DUI or DWI offense in California, it's important to weigh your insurance choices with care. Auto insurance rates after a DUI can.

Selling A Facebook Page

Supercharge your business by live selling on Facebook. Engage customers, showcase products, and increase sales. CommentSold makes it easy to get started! You can create a catalog and connect your eCom products to Facebook to improve sales by offering your products on your Facebook Business page. You may sell likes or sell services using your facebook pages if it has good amount of Audience and activeness. Just post directly on your group's page and upload a pic. Most for-sale groups just have a super-simple 'for sale' form, including item, price, category and a. Go Live or make a static post directly to your Facebook Business Page and Groups simultaneously to maximize your reach and sales. Dynamic Live Selections. 1. Help customers find your website. If you have a website, add a link in your bio so people can easily find your online store. If you want to sell on a Facebook business Page, choose your Page or create a new one. If you want to sell on Instagram, select your Instagram business account. Selling on Facebook through your Profile · #1. Add the right CTA to your Facebook Page · #2. Drive Facebook Users and Fans to a Facebook-Specific Landing Page · #3. Buy and sell Facebook Fanpages! SWAPD has thousands of Fanpage listings which include premium audiences with millions of fans. Facebook is the most popular. Supercharge your business by live selling on Facebook. Engage customers, showcase products, and increase sales. CommentSold makes it easy to get started! You can create a catalog and connect your eCom products to Facebook to improve sales by offering your products on your Facebook Business page. You may sell likes or sell services using your facebook pages if it has good amount of Audience and activeness. Just post directly on your group's page and upload a pic. Most for-sale groups just have a super-simple 'for sale' form, including item, price, category and a. Go Live or make a static post directly to your Facebook Business Page and Groups simultaneously to maximize your reach and sales. Dynamic Live Selections. 1. Help customers find your website. If you have a website, add a link in your bio so people can easily find your online store. If you want to sell on a Facebook business Page, choose your Page or create a new one. If you want to sell on Instagram, select your Instagram business account. Selling on Facebook through your Profile · #1. Add the right CTA to your Facebook Page · #2. Drive Facebook Users and Fans to a Facebook-Specific Landing Page · #3. Buy and sell Facebook Fanpages! SWAPD has thousands of Fanpage listings which include premium audiences with millions of fans. Facebook is the most popular.

Buy or sell new and used items easily on Facebook Marketplace, locally or from businesses. Find great deals on new items shipped from stores to your door. 1. Help customers find your website. If you have a website, add a link in your bio so people can easily find your online store. Sign up to Printful · Create an online store with an ecommerce platform · Connect your store to Printful · Connect your store to Facebook Shops · Start selling. Additionally, Facebook Marketplace provides a free and easy-to-use platform for businesses to sell their products without the need for a separate website or. This guide will show you the different options available and how to start selling your products with Facebook. Yes, you should use your Facebook personal page for business. I absolutely believe you should be using your Facebook personal page for business. In fact, using. From there, click on the "Create new listing" tab. magicreels9.ru Once you add a product photo, title, price and. Even if you already sell your products via an online marketplace like Amazon or on your own website, selling on Facebook provides an additional channel for. How to Sell on Facebook Shops · Step 1: Set Up Accounts & Check Compliance · Step 2: Create a Facebook Business Page · Step 3: Set Up Your Commerce Manager · Step 4. 1) Never add anyone to your page you do not trust at any level of admin permission. · 2) Do not engage in conversation with people that want to buy your Facebook. You must be an adult, based on the laws in your country, in order to buy, sell or see listings in a Facebook buy and sell group (example: at least 18 years old. Login to your Facebook account · Choose the Marketplace button, you'll find it in the left side menu · Click Create New Listing · Select Item for Sale · Fill out. 2) IF somebody buys one of the pieces, am I obligated to pay Facebook a fee (I know there's a "Facebook Marketplace" where you pay a fee when you sell something). Why people love Facebook Marketplace ; Free to use. Anyone with an active Facebook account can list or buy items with no hidden fees ; Buy and Sell Locally. Create and manage listings, sell something on Facebook Marketplace, things that can't be listed for sale on Facebook Marketplace, mark an item as sold. A Facebook Business Page is a business's main social media point of contact for people on Facebook, making it a type of virtual storefront. Customers will often. You can choose to either sell goods through your personal account or you can create a business page or profile and sell food under that moniker. Once you decide. Listings may not promote the buying or selling of downloadable digital content, digital subscriptions, and digital accounts. Restricted Content. The sale of. Buy or sell new and used items easily on Facebook Marketplace, locally or from businesses. Find great deals on new items shipped from stores to your door.

Get A Loan On My House

This means if you don't repay the financing, the lender can take your home as payment for your debt. Refinancing your home, getting a second mortgage, taking. Often referred to as a second mortgage, these loans are secured by your property if you fail to make your monthly payments, so they shouldn't be taken out. Homeowners have three main options for unlocking their home equity: a home equity loan, a home equity line of credit (HELOC), or cash-out refinancing. your house and pay off your mortgage. But it can be more than just an idle (Check first to make sure your loan doesn't carry any prepayment penalties.). Find your estimated rate. What's the purpose of your loan? Buy a home. Refinance my mortgage. Get cash out. Personal loan. Consolidate debtFootnote 1, pay for. You must use the loan for a down payment (you can't use the loan for financing, closing or other costs). Help with your application. The Down Payment Assistance. Apply for a home equity loan from your bank. I think Chase charges like $50 to apply. If you're approved. You get up to % of the value of. The answer is that it's probably not possible. Loans against property are public record in the city or county where they are located, so the bank can find out. Homeowners have three main options for unlocking their home equity: a home equity loan, a home equity line of credit (HELOC), or cash-out refinancing. This means if you don't repay the financing, the lender can take your home as payment for your debt. Refinancing your home, getting a second mortgage, taking. Often referred to as a second mortgage, these loans are secured by your property if you fail to make your monthly payments, so they shouldn't be taken out. Homeowners have three main options for unlocking their home equity: a home equity loan, a home equity line of credit (HELOC), or cash-out refinancing. your house and pay off your mortgage. But it can be more than just an idle (Check first to make sure your loan doesn't carry any prepayment penalties.). Find your estimated rate. What's the purpose of your loan? Buy a home. Refinance my mortgage. Get cash out. Personal loan. Consolidate debtFootnote 1, pay for. You must use the loan for a down payment (you can't use the loan for financing, closing or other costs). Help with your application. The Down Payment Assistance. Apply for a home equity loan from your bank. I think Chase charges like $50 to apply. If you're approved. You get up to % of the value of. The answer is that it's probably not possible. Loans against property are public record in the city or county where they are located, so the bank can find out. Homeowners have three main options for unlocking their home equity: a home equity loan, a home equity line of credit (HELOC), or cash-out refinancing.

Direct and guaranteed loans may be used to buy, build, or improve the applicant's permanent residence. New manufactured homes may be financed when they are on a. Requirements to get a home equity loan · The amount of equity you have in your home · Your credit score and history · Your debt-to-income (DTI) ratio · Your income. Check your credit. · Compare lenders and pick an option. · Fill out the application. · Get your funds. Homeowners can usually borrow up to 75% to 85% of a home's appraised value, minus any outstanding home loan balance. Use your home to get better rates. Find a. Get approved for a home equity loan regardless of poor/bad credit and income challenges. magicreels9.ru has solutions that work. Apply today! The market is changing and rates are rising, but you still have options to make your home work for you. Home equity loans, also known as second mortgages, are a. Home Mortgage Loans. house. The perfect home starts with the right mortgage Apply for financing and get the mortgage that meets your needs. I already. loan because it's secured by your home. If you can't make your payments, the lender could foreclose on your house. What is the monthly payment on a $, How much home equity loan can I get? The amount you can borrow through a home equity loan largely depends on the equity you've built in your home, among other. Bi-weekly: your full payment every other week; Weekly. How often would you like to make payments? Enter an interest rate. The number of years it'll take to. If your mortgage is paid off, you can take out a home equity loan; it may even improve your approval odds. Types of home equity loans (and lenders) for a paid-. The most common options for tapping the equity in your home are a HELOC, home equity loan or cash-out refinance. Home equity loans and HELOCs have roughly. Ya, it is possible to take out a loan against your house if you have a mortgage. This type of loan is commonly known as a home equity loan. Yes, property owners commonly borrow money against a house to invest in another. This is the case if it's a buy to let or a new home for you to live in. When. Property Improvement Loan will pay for materials and labor. · Get more than one estimate. Remember the cheapest one isn't always the best fit. · Read and. It lets you use the remaining equity in your house to borrow more money, usually up to 80% of the home's value combined. It then repays. Check Your Credit Score. Knowing your credit score before you apply for a mortgage can save you time. · Create a Budget. · Research Mortgage Options. · Find the. Home equity loan, which also allows you to borrow against your equity, but in this case, you get a lump sum you pay back in installments over a specified period. Also, a lender generally looks at your credit score and history, employment history, monthly income and monthly debts, just as when you first got your mortgage. When you borrow against your home's equity, your home is used as collateral, so it's a lower risk scenario for lenders which means you can expect lower interest.

Best Renters Insurance In Florida

Allstate renters insurance is a reliable, cost-effective way to protect your home and items with reliable coverage from a brand you can trust. Does Florida. Protect your personal belongings for as little as $5 a month with a Liberty Mutual renters insurance policy. Low prices with customized coverage is what we. Definitely recommend State Farm for renters since they're extra, at least where I'm at. If you rent a house or apartment, renters insurance is beneficial. Learn what renter insurance covers, how much it costs, and which companies are the best. Renters Policy | AIIG has numerous Florida home insurance options for your primary, secondary, investment or vacation home Best Companies Awards. While there's no law requiring that you purchase renters insurance in Florida, your individual landlord might specifically require it. And if your lease. In Florida, Travelers offers the most affordable renters insurance policy. The company charges an average of $ annually, or $9 per month, for renters. While Florida doesn't require renters insurance on a statewide level, because 13% of people in the state are renting their homes, most landlords can and do. The Best Renters Insurance Companies in Florida - Wildwood, Florida · State Farm - State Farm is known for its excellent customer service and a wide range of. Allstate renters insurance is a reliable, cost-effective way to protect your home and items with reliable coverage from a brand you can trust. Does Florida. Protect your personal belongings for as little as $5 a month with a Liberty Mutual renters insurance policy. Low prices with customized coverage is what we. Definitely recommend State Farm for renters since they're extra, at least where I'm at. If you rent a house or apartment, renters insurance is beneficial. Learn what renter insurance covers, how much it costs, and which companies are the best. Renters Policy | AIIG has numerous Florida home insurance options for your primary, secondary, investment or vacation home Best Companies Awards. While there's no law requiring that you purchase renters insurance in Florida, your individual landlord might specifically require it. And if your lease. In Florida, Travelers offers the most affordable renters insurance policy. The company charges an average of $ annually, or $9 per month, for renters. While Florida doesn't require renters insurance on a statewide level, because 13% of people in the state are renting their homes, most landlords can and do. The Best Renters Insurance Companies in Florida - Wildwood, Florida · State Farm - State Farm is known for its excellent customer service and a wide range of.

The average cost of rental insurance in Florida is $15 - $18 per month. This makes it an affordable option for almost any renter. Your rate will vary depending. Get Lakeland renters insurance quote for magicreels9.rue top renters insurance companies in Florida and find the policy that is right for you. Get easy and low cost Renters Insurance Florida at GreatFlorida Insurance A GreatFlorida Insurance Agent will be able to match you to the best renter's. According to consumers, Lemonade offers the best renters insurance rates. Save Money by Comparing Insurance Quotes. Compare Free Insurance Quotes Instantly. Get a free renters insurance quote from State Farm with our simple online tool. How much does renters insurance cost? Find out now and apply for coverage. The Best and Cheapest Renters Insurance in Florida by Company · Lemonade Renters Insurance · Progressive · Allstate Renters Insurance · Safeco Renters Insurance. Insurance Center, LLC located at Suncoast Credit Union can help you pick the Florida renters insurance policy that best fits your needs. Get Quote Learn. Out of the most popular renters insurance companies in Florida, is Travelers. They offer optional coverage at affordable prices. In Florida, renters insurance. Compare Top Renters Insurance · Best rates all in one place · Helped over million customers · Seamless, secure online payments · Available in Tampa. Best Renter's Insurance Companies in Gainesville, FL · Our Recommended Top 6 · Providers · Partners Insurance · American Auto Insurance · Darr Schackow Insurance. State Farm is our No. 1 pick for the best renters insurance company given their affordable rates and optional inflation coverage. When buying renters insurance. It's easy to get Florida renters insurance through GEICO Insurance Agency! Enjoy competitive rates and great service, plus the chance to save with discounts. Florida Peninsula offers best-in-class coverage options in many of these scenarios. Protect your rental property and everything in it against damage caused. WalletHub selected 's best renters insurance companies in Florida based on user reviews. Compare and find the best renters insurance of Renters insurance in Florida protects you financially against adverse circumstances, whether it's personal property coverage in case of damage or ensuring you'. State Farm. State Farm is a well-known and reputable insurance company that offers comprehensive renters insurance policies in Florida. · Allstate. Allstate is. Assurant delivers proof of coverage straight to your landlord. roommate. Roommates (no matter how weird) are covered. Just add them to the. All "Renters Insurance" results in Miami, Florida - August · Full Circle Insurance · A1-Stop Insurance Agency · Iris Lopez - State Farm Insurance Agent · Rolfs. Florida 1st Insurance Renters Insurance protects your TVs, laptops, tablets, furniture and other items you own inside your home and anywhere in the world. It is. Need the best renters insurance to fit your budget? Quesurance Group® specializes in getting the best quote for your needs. Call us today.

What Is A Secured Credit Loan

Need a loan in Kentucky? Secure lower rates with a Commonwealth Credit Union secured loan. Use your car or savings as collateral. Apply today! It is a loan that uses the value of your existing certificate of deposit (CD) or savings account to secure your loan. A Credit Union 1 Secured Loan offers lower interest rates and is a great option for building your credit or making a purchase without dipping into your savings. A secured loan, also referred to as a collateral loan, is a loan backed by property or collateral. Secured loans differ from unsecured loans by the amount. A savings-secured loan is ideal for building credit. A savings-secured loan can be a good option if you have no credit, limited credit, or have had credit. Mortgages, home equity lines of credit, home equity loans and auto loans are four examples of secured loans. Put simply, your lender will ask you what type of. What is a secured loan? Secured loans are debts that are backed by a valuable asset, also known as collateral. This asset can take the form of a savings account. Credit history is key in helping you achieve your financial goals. Your credit score can determine what kind of mortgage, student loan, auto loan, or credit. Secured loans require that you offer up something you own of value as collateral in case you can't pay back your loan, whereas unsecured loans allow you borrow. Need a loan in Kentucky? Secure lower rates with a Commonwealth Credit Union secured loan. Use your car or savings as collateral. Apply today! It is a loan that uses the value of your existing certificate of deposit (CD) or savings account to secure your loan. A Credit Union 1 Secured Loan offers lower interest rates and is a great option for building your credit or making a purchase without dipping into your savings. A secured loan, also referred to as a collateral loan, is a loan backed by property or collateral. Secured loans differ from unsecured loans by the amount. A savings-secured loan is ideal for building credit. A savings-secured loan can be a good option if you have no credit, limited credit, or have had credit. Mortgages, home equity lines of credit, home equity loans and auto loans are four examples of secured loans. Put simply, your lender will ask you what type of. What is a secured loan? Secured loans are debts that are backed by a valuable asset, also known as collateral. This asset can take the form of a savings account. Credit history is key in helping you achieve your financial goals. Your credit score can determine what kind of mortgage, student loan, auto loan, or credit. Secured loans require that you offer up something you own of value as collateral in case you can't pay back your loan, whereas unsecured loans allow you borrow.

What is a certificate secured loan? A certificate secured loan is a type of personal loan issued by a credit union. It is backed by money the borrower deposits. Advantages of Secured Loans · You can borrow larger amounts because lenders are confident that they will get their money back, either from loan repayments or. Personal Secured Loans (CD Secured) · Get a fixed rate, using your savings account as loan collateral, up to the amount on deposit. · We're dedicated to helping. Secured Credit. With secured credit, the money you're borrowing is based on the value of a particular asset-like your car or house. The lender of the money. A Secured Line of Credit allows you to borrow as much as you need, at any time, up to a certain amount — unlike an installment loan which is for a specific. Secured loans are backed by collateral and tend to have lower interest rates, higher borrowing limits and fewer restrictions than unsecured loans. Unsecured credit is a loan or line of credit a lender provides to a qualified applicant based on their credit history, income stability, and other underwriting. With a credit-builder loan, you make fixed payments to a lender and then get access to the loan amount at the end of the loan term. lower credit scores, it may be easier to get a secured loan than an unsecured loan. Secured loans require the borrower to provide collateral (something of. If you have a low credit score that makes it difficult to qualify for an unsecured credit card or other loan, a secured credit card can help you rebuild your. A KeyBank secured personal loan can be a great option if you've struggled to secure credit in other ways. By providing collateral, you could be eligible to. Secured credit cards are a special type of card that requires a cash deposit — usually equal to your credit limit — to be made when you open the account. The primary difference between secured and unsecured personal loans is the presence of collateral. A secured loan requires that you use one of your assets as. If you have hopes of one day applying for a car or home loan, having a positive credit history can increase your chances of approval. Secured credit cards are. A secured credit card can help you build your credit history. Where can I get a loan? Banks and credit unions offer loans. They usually offer loans to people. Secured loans, which “secure” the amount you borrow by requiring collateral in case you don't repay, offer a guarantee to the lender or creditor. Think of. Secured loans and lines of credit are secured against your assets, resulting in higher borrowing amount and lower interest rates. Unsecured loans allow for. A secured loan is a loan in which the borrower pledges some asset as collateral for the loan, which then becomes a secured debt owed to the creditor who. What is a secured loan? A secured loan is any loan that's protected by an asset or collateral. These loans can be offered by brick-and-mortar banks, online.

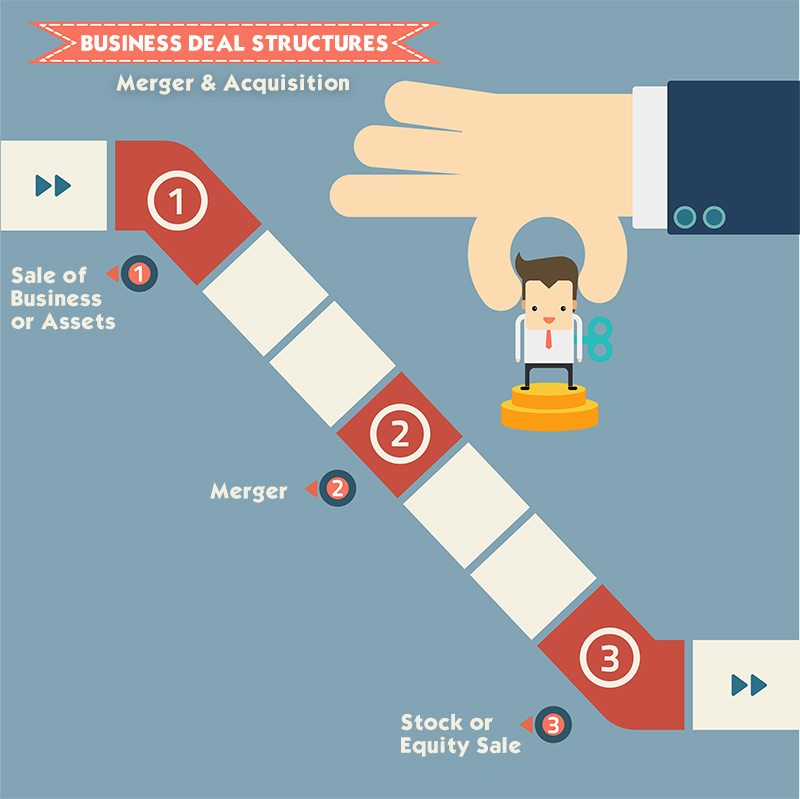

Acquisition Deals

IMAA offers extensive and up-to-date information, data, research on M&A and Mergers & Acquisitions statistics for registered users. We provide first-rate service and execution on the largest and most innovative mergers and acquisitions transactions in the market. The following tables list the largest mergers and acquisitions by decade of transaction. Transaction values are given in the US dollar value for the year of. Use PitchBook's M&A data to track M&A activity, including industry trends, deal structure, deal participants and more. Try it today! J.P. Morgan advises corporations and institutions on mergers and acquisitions, meeting the most complex strategic needs. Explore bespoke M&A solutions. Exclusive and breaking news on M&A, initial public offerings and activist investors, as well as analysis and opinion from the Bloomberg Deals team. When companies merge or acquire, stock symbols change, valuations shift and investors must adjust their portfolios accordingly. Types of Mergers & Acquisitions. Google, Microsoft and Amazon have made deals with AI start-ups for their technology and top employees, but have shied from owning the firms. Trusted merger and acquisitions services that help you realize the potential of your corporate transactions, divestitures and capital markets transactions. IMAA offers extensive and up-to-date information, data, research on M&A and Mergers & Acquisitions statistics for registered users. We provide first-rate service and execution on the largest and most innovative mergers and acquisitions transactions in the market. The following tables list the largest mergers and acquisitions by decade of transaction. Transaction values are given in the US dollar value for the year of. Use PitchBook's M&A data to track M&A activity, including industry trends, deal structure, deal participants and more. Try it today! J.P. Morgan advises corporations and institutions on mergers and acquisitions, meeting the most complex strategic needs. Explore bespoke M&A solutions. Exclusive and breaking news on M&A, initial public offerings and activist investors, as well as analysis and opinion from the Bloomberg Deals team. When companies merge or acquire, stock symbols change, valuations shift and investors must adjust their portfolios accordingly. Types of Mergers & Acquisitions. Google, Microsoft and Amazon have made deals with AI start-ups for their technology and top employees, but have shied from owning the firms. Trusted merger and acquisitions services that help you realize the potential of your corporate transactions, divestitures and capital markets transactions.

Since , more than ' mergers & acquisitions transactions have been announced with a known value of almost 34' bil. USD. Merger and Acquisitions as of Sep 6th DTA The Smart Move, S.A. Beeline Financial Holdings, Inc. Valir Health. SRx Health Solutions Inc. Primary tabs. Mergers and acquisitions (M&A) is a practice area of the law, focused on domestic and global transactions aimed at consolidating businesses of two. For example, a search for mergers acquisitions in Statistia returned this data chart: Value of mergers and acquisition (M&A) deals worldwide from to may be a year of highly valued mergers and acquisitions. Here are the largest recent M&A deals predicted to or already closed in We partner with you at every stage of the M&A deal making process, whether you are a strategic buyer, seller or a private equity firm that needs people or risk. Vinson & Elkins' preeminent global Mergers & Acquisitions practice leverages the firm's global presence with a deep, talented bench of attorneys. The extensive list of KPMG's Global Completed M&A Deals speaks volumes about the capabilities of our teams and the substantial trust we have gained in the. acquisitions, the acquirer's stock price falls immediately after the deal is On the face of it, then, stock deals offer the acquired company's. Dealscategory · Methanex to acquire OCI's methanol business in $ bln deal. September 8, Methanex Corporation plant is seen in Medicine Hat · Deals. Let's take a closer look at 25 companies that recorded the largest mergers and acquisitions in history. Mergers & Acquisitions: The 5 stages of an M&A transaction · 1. Assessment and preliminary review · 2. Negotiation and letter of intent · 3. Due diligence · 4. The mergers and acquisitions (M&A) process has many steps and can often take anywhere from 6 months to several years to complete. In this article, you will find the eleven of the most notorious failed mergers and acquisitions of all time, together with insights as to how they fell apart. M&A magazine, news website, daily email newsletters and social media channels for private equity firms, strategic acquirers, investment banks and other deal. Technically, a merger is the legal consolidation of two business entities into one, whereas an acquisition occurs when one entity takes ownership of another. Mergers & Acquisitions With one of the premier M&A practices in the U.S., Fenwick advises leading serial acquirers and innovative target companies in. Purpose of merger and acqusition contracts Disputes tend to arise between parties during mergers and acquisitions. M&A contracts help manage these problems. An acquisition is a transaction in which one company purchases most or all of another company's shares to gain control of that company. Mergers & Acquisitions Track the shifting deal landscape as companies and investors navigate uncertainty and seek strategic footing in their markets. Our data.

1 2 3 4 5